Exness Minimum Deposit

At Exness, we believe that trading should be accessible to everyone, regardless of their financial background. That’s why we’ve designed our minimum deposit requirements to be as flexible and affordable as possible. Whether you’re a novice trader just starting out or an experienced trader looking to diversify your portfolio, Exness offers account options that cater to all levels of expertise and financial capability.

Understanding our minimum deposit requirements is the first step towards embarking on a seamless and rewarding trading journey with us. By offering low minimum deposit amounts, Exness ensures that you can start trading with minimal financial commitment. This approach not only lowers the barrier to entry for new traders but also provides seasoned traders with the flexibility to manage their funds more efficiently.

Overview of Minimum Deposit Requirements

Exness offers a range of account types, each with its own minimum deposit requirement tailored to meet the needs of different traders. Generally, the minimum deposit amounts are designed to be accessible, ensuring that both novice and experienced traders can start trading without significant financial barriers. The specific minimum deposit requirements vary depending on the type of account you choose and the region you are in.

For most standard accounts, Exness has set a very low or even no minimum deposit requirement, making it easy for new traders to enter the market. This flexibility allows traders to start with a small investment and gradually increase their trading capital as they become more comfortable and experienced. However, more advanced account types, such as Pro or Raw Spread accounts, may have higher minimum deposit requirements to cater to more experienced traders who need access to enhanced features and tighter spreads. Additionally, regional regulations and policies may influence the minimum deposit amounts, so it’s essential to check the specific requirements for your location before opening an account.

Account Types and Their Minimum Deposits

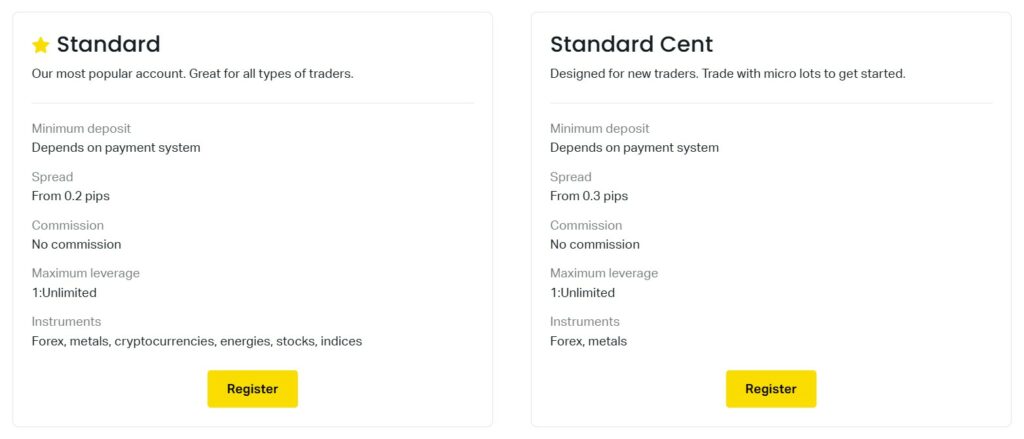

Standard Accounts

The Standard Account at Exness is designed to be accessible for all types of traders, especially those who are new to the forex market. The minimum deposit for a Standard Account is typically very low, often starting at just $1. This account offers a balanced mix of trading conditions, including competitive spreads and no commission on trades, making it an ideal choice for those beginning their trading journey.

Standard Cent Accounts

The Standard Cent Account is perfect for beginners who want to practice trading with minimal financial risk. With a minimum deposit requirement as low as $1, traders can start trading in cent lots, which reduces the risk associated with larger trades. This account type allows new traders to get a feel for the market and develop their trading strategies in a low-risk environment.

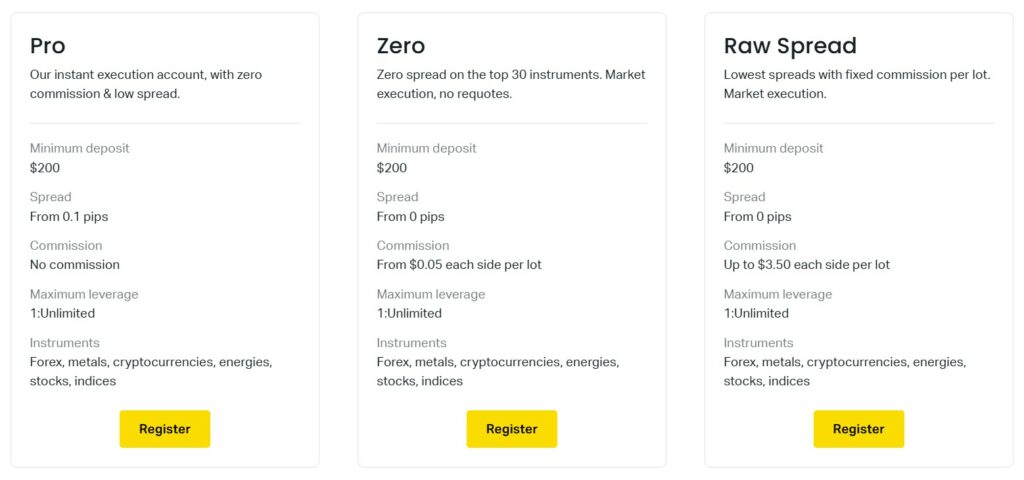

Pro Accounts

The Pro Account is tailored for more experienced traders who require advanced trading features and conditions. The minimum deposit for a Pro Account is higher, typically starting at $200. This account type offers tighter spreads, faster execution speeds, and access to a wider range of financial instruments, making it suitable for traders who need more sophisticated trading tools and greater market exposure.

Raw Spread Accounts

Raw Spread Accounts are designed for traders who prefer trading with minimal spreads. The minimum deposit requirement for this account type is usually around $200. Raw Spread Accounts provide access to spreads as low as 0.0 pips, combined with a small commission per trade. This account is ideal for scalpers and high-frequency traders who need the most precise pricing and execution.

Zero Accounts

The Zero Account offers zero spreads on major currency pairs, which can significantly reduce trading costs. The minimum deposit for a Zero Account is typically $500, reflecting the premium trading conditions provided. This account is best suited for traders who want to maximize their profit potential by minimizing the cost of spreads.

Standard Plus Accounts

The Standard Plus Account combines the features of the Standard Account with additional benefits and services. The minimum deposit for this account type varies but is generally higher than the standard account. Standard Plus Accounts provide enhanced support and exclusive trading tools, making them suitable for traders looking for a more comprehensive trading experience.

Each of these account types at Exness is designed to cater to different trading needs and levels of experience, ensuring that every trader can find an account that fits their specific requirements and trading goals.

Here is a table summarizing the different account types and their minimum deposit requirements at Exness:

| Account Type | Minimum Deposit | Description |

| Standard Account | $1 | Accessible for all traders, especially beginners. Offers competitive spreads and no commission on trades. |

| Standard Cent Account | $1 | Ideal for beginners, trades in cent lots to reduce financial risk. Allows new traders to practice and develop strategies with minimal risk. |

| Pro Account | $200 | Designed for experienced traders. Offers tighter spreads, faster execution speeds, and access to a wider range of financial instruments. |

| Raw Spread Account | $200 | Suited for scalpers and high-frequency traders. Provides access to spreads as low as 0.0 pips with a small commission per trade. |

| Zero Account | $500 | Best for traders who want zero spreads on major currency pairs. Minimizes trading costs, ideal for maximizing profit potential. |

| Standard Plus Account | Varies | Combines features of the Standard Account with additional benefits. Provides enhanced support and exclusive trading tools for a more comprehensive trading experience. |

Regional Differences

Exness provides tailored services to meet the diverse needs of traders from different regions around the world. While the core offerings remain consistent, there are some regional differences in terms of minimum deposit requirements, payment methods, and regulatory conditions that traders should be aware of.

Minimum Deposit Variations

Minimum deposit amounts can vary based on the country or region due to local regulatory requirements and market conditions. For example, certain regions might have higher minimum deposit requirements for specific account types to comply with local financial regulations or to align with the typical trading capital of traders in that area. It’s important for traders to check the specific minimum deposit requirements applicable to their region when opening an account with Exness.

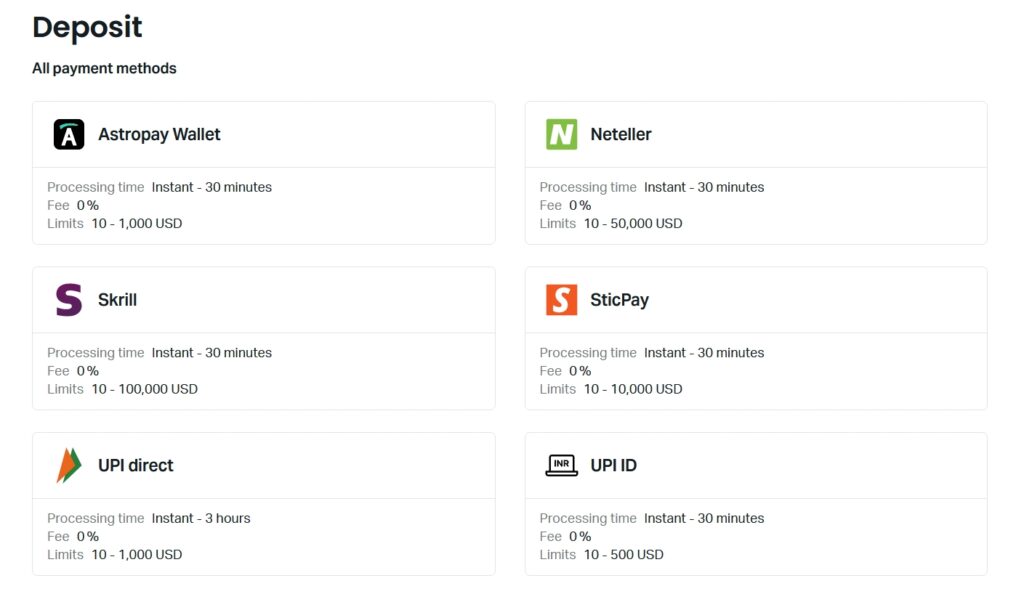

Payment Methods and Accessibility

The availability of payment methods can also differ by region. Exness strives to offer a variety of local and international payment options, but some methods may be more prevalent or preferred in certain areas. For instance, while electronic payment systems like Skrill and Neteller are popular in Europe and Asia, other regions might rely more on bank transfers or local payment solutions. Understanding the available deposit and withdrawal options in your region ensures a smoother and more convenient transaction process.

Regulatory Compliance

Regulatory conditions and compliance requirements can affect how services are offered in different regions. Exness operates under the regulations of multiple financial authorities, including the Financial Services Authority (FSA) of Seychelles, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Conduct Authority (FCA) in the UK. These regulations help ensure the safety and security of trading activities, but they may also result in specific conditions or limitations for traders in certain regions.

By understanding these regional differences, traders can better navigate the requirements and options available to them, ensuring they make the most of their trading experience with Exness.

Deposit Methods and Their Minimum Requirements

Bank Cards

Minimum Deposit: $1 Depositing funds using bank cards is a widely accessible and convenient method for Exness clients. Exness supports major bank cards, including Visa and Mastercard. To make a deposit, simply log into your Exness account, select the ‘Bank Card’ option, enter your card details, specify the amount, and confirm the transaction. The minimum deposit amount for bank cards is typically $1, allowing traders to start with a very low initial investment.

Electronic Payment Systems (EPS)

Minimum Deposit: $1 Exness offers a variety of electronic payment systems to provide flexibility and convenience. Popular options include Neteller, Skrill, and WebMoney. These systems allow for instant deposits, making funds immediately available for trading. To deposit via EPS, choose your preferred system, log into your EPS account, and authorize the transaction. The minimum deposit amount for most EPS is $1, making it an accessible option for traders of all levels.

Bank Transfers

Minimum Deposit: $200 For traders who prefer direct bank transactions, Exness supports both local and international bank transfers. This method is ideal for depositing larger sums of money securely. To initiate a bank transfer, log into your Exness account, choose the ‘Bank Transfer’ option, and follow the provided instructions. While the minimum deposit for bank transfers is generally higher, at around $200, it offers a reliable and straightforward way to fund your trading account.

By offering a range of deposit methods with varying minimum requirements, Exness ensures that traders can choose the most suitable option for their needs and financial capabilities. Each method is designed to provide a seamless and secure transaction experience, enabling you to focus on your trading activities.

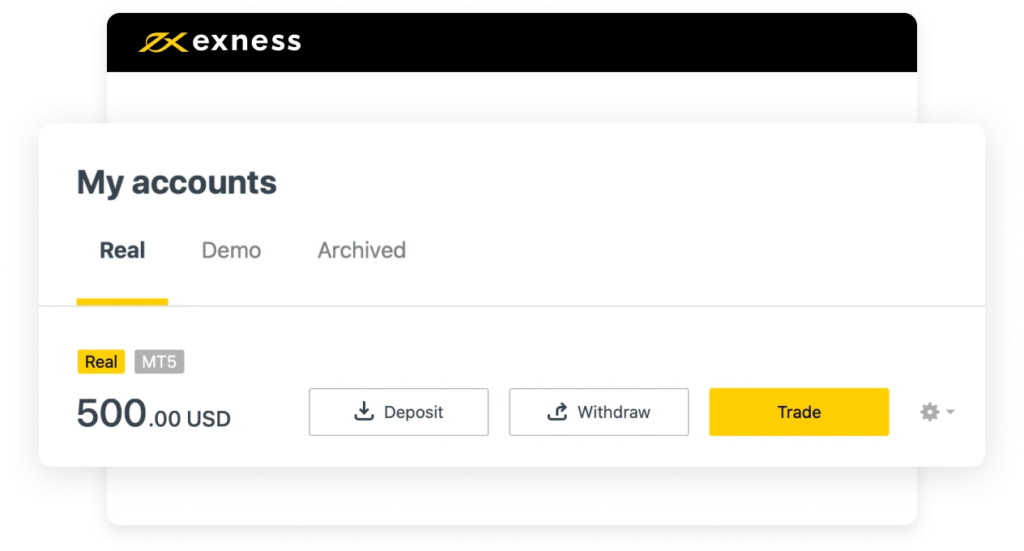

How to Make a Deposit

Step-by-Step Guide for Each Deposit Method

1. Bank Cards

Steps:

- Log in to your Exness account.

- Navigate to the ‘Deposit’ section.

- Select ‘Bank Card’ as your deposit method.

- Enter the amount you wish to deposit (minimum $1).

- Fill in your card details (card number, expiration date, CVV).

- Confirm the transaction.

- Your funds should appear in your trading account instantly.

Tips:

- Ensure your card is valid and has sufficient funds.

- Double-check your card details to avoid transaction errors.

2. Electronic Payment Systems (EPS)

Steps:

- Log in to your Exness account.

- Go to the ‘Deposit’ section.

- Select your preferred EPS (e.g., Neteller, Skrill, WebMoney).

- Enter the amount you wish to deposit (minimum $1).

- Log in to your EPS account when prompted.

- Authorize the transaction.

- The funds will be credited to your trading account instantly.

Tips:

- Make sure your EPS account has enough funds.

- Ensure that your EPS account is verified and active.

3. Bank Transfers

Steps:

- Log in to your Exness account.

- Head to the ‘Deposit’ section.

- Choose ‘Bank Transfer’ as your deposit method.

- Enter the amount you wish to deposit (minimum $200).

- Follow the on-screen instructions to complete the bank transfer process.

- Note the provided bank details and reference number.

- Initiate the transfer from your bank using the provided details.

- Your funds will appear in your trading account within a few business days.

Tips:

- Ensure all bank details and reference numbers are correctly entered to avoid delays.

- Check with your bank for any applicable fees and processing times.

By following these steps, you can easily and securely deposit funds into your Exness trading account using the method that best suits your needs. Each method is designed to provide a seamless experience, allowing you to focus on your trading activities with confidence.

Benefits of Low Minimum Deposits

Accessibility for New Traders

One of the most significant advantages of low minimum deposits at Exness is the increased accessibility for new traders. By allowing traders to start with a minimal financial commitment, Exness opens the door for individuals who might be hesitant to invest large sums initially. This low barrier to entry enables beginners to explore the trading environment, gain practical experience, and build confidence without risking substantial capital. It also allows them to test their trading strategies in real market conditions, making the learning process more effective and less stressful.

Flexibility for Experienced Traders

Low minimum deposits also provide flexibility for experienced traders. Even seasoned traders appreciate the ability to manage their funds more dynamically. With Exness, they can open multiple accounts with small initial deposits to diversify their trading strategies across different markets and instruments. This flexibility supports advanced trading techniques such as hedging and portfolio diversification. Additionally, low minimum deposits make it easier for traders to take advantage of market opportunities as they arise, ensuring they can act swiftly without the need to transfer large amounts of money each time they wish to trade.

Risk Management and Financial Planning

Low minimum deposits play a crucial role in effective risk management and financial planning. Traders can allocate a smaller portion of their overall investment capital to each trading account, thereby spreading risk and minimizing potential losses. This approach allows for better control over trading funds and reduces the psychological pressure associated with high-stake investments. By starting with a low deposit, traders can gradually increase their investment as they become more confident and successful, aligning their trading activities with their financial goals and risk tolerance.

Conclusion

Exness’s low minimum deposit requirements are designed to make trading accessible and flexible for everyone, from beginners to seasoned traders. By lowering the financial barriers to entry, Exness allows new traders to start their trading journey with minimal risk, providing a safe environment to learn and develop their strategies. Experienced traders benefit from the ability to manage their funds more dynamically and take advantage of diverse market opportunities without needing to commit large sums of money upfront.

This approach not only fosters a more inclusive trading community but also supports effective risk management and financial planning. By offering various account types and deposit methods tailored to different trading needs, Exness ensures that every trader can find a suitable option to meet their specific goals. Ultimately, the low minimum deposit policy underscores Exness’s commitment to providing a seamless and supportive trading experience, empowering traders to grow and succeed in the financial markets.

Are there any regional differences in the minimum deposit requirements?

Yes, minimum deposit requirements can vary by region due to local regulatory conditions and market norms. It's important to check the specific requirements applicable to your region when opening an account with Exness.

What deposit methods are available at Exness?

Exness offers a variety of deposit methods, including bank cards (Visa, Mastercard), electronic payment systems (such as Neteller, Skrill, WebMoney), bank transfers (local and international).

Are there any fees for making a deposit?

Exness generally does not charge fees for making deposits. However, some banks or payment providers may apply their own fees. It's advisable to check with your payment provider for any applicable charges.

How long does it take for my deposit to be credited to my account?

Deposits via bank cards, electronic payment systems are typically credited to your account instantly. Bank transfers may take a few business days to process.

Can I start trading with a small deposit?

Yes, Exness allows you to start trading with a very low minimum deposit, especially with Standard and Standard Cent accounts, which require only $1. This low barrier to entry makes it easy for new traders to begin their trading journey with minimal financial risk.

How do I make a deposit into my Exness account?

To make a deposit, log into your Exness account, navigate to the 'Deposit' section, select your preferred deposit method, enter the required details and amount, and confirm the transaction. Detailed steps are provided for each deposit method in the Exness platform.